Now that you’ve learned about the overall basics of cryptocurrencies, here’s how you can get started with exchanges.

Crypto Exchanges

Let's say you decided to invest some money into Ethereum after learning about it.

You want to buy some ETH that you can hold onto for a long time. You’re excited and you can’t wait to get your hands on some.

But wait, where do you even go? How can you get some?

In the previous lesson, we covered two different ways you can get crypto.

But out of the two, there’s only one widely used option: crypto exchanges.

What is a crypto exchange?

A crypto exchange is a place where you can buy and sell cryptocurrencies.

Think of it like going to a foreign currency exchange. You can swap your local country’s currency for a certain amount of another country's currency at an exchange.

Except here, you use different types of coins (Samples: Ethereum, Solana, Bitcoin, etc.)

Pretty simple, right?

Given the nature of crypto, there are two types of exchanges:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

Let’s cover both of them individually.

Centralized Exchanges (CEX)

Centralized exchanges are by far the most popular platforms used when buying or selling cryptocurrencies.

They operate like a traditional stock exchange by connecting buyers and sellers together.

CEXs are popular because they offer speed, convenience, and typically high levels of security.

However, by using a CEX, you are trusting a company to look after your money, and with this comes some drawbacks:

- In the unlikely event that the exchange is hacked, then everyone is at risk of losing their cryptocurrencies kept on the platform. There is no guarantee that the company will reimburse you for the losses.

- During times of harsh market conditions or high volatility (price swings), exchanges are able to pause trading and withdrawals, preventing users from accessing their funds. If the exchange goes bankrupt, then user funds may be affected.

In other words, you delegate the control of your assets to the exchange and hope that they are able to keep it safe and secure.

To avoid these types of problems, many users withdraw their assets from the exchange into a private wallet as soon as they make their purchase.

👛 To learn more, make sure your visit the wallet chapter.

Here are a few examples of some popular centralized crypto exchanges.

- Binance (Binance US)

- Coinbase

- Kraken

There are many others, but these are the main ones that attract the highest level of trading activity.

What in the FTX?

What happened to the 3rd biggest exchange?

Founded in May 2019, FTX grew to be one of the largest centralized cryptocurrency exchanges in 2021. Headquartered in the Bahamas, it had a global presence and had over a hundred subsidiaries that acted as its local branches.

Upon reading a concerning report by web3 news outlet Coindesk, customers began withdrawing all their assets and liquidity from the platform.

With this large wave of withdrawals affecting its platform, FTX froze withdrawals amidst a liquidity crisis - it didn’t have enough reserve assets to “cash out” its customers who were promised that their assets were kept safe and not used for other purposes (such as lending, trading, or investment).

Shortly after looking for emergency funds to meet this crisis, FTX filed for Chapter 11 Bankruptcy and all remaining customer assets were frozen and locked on the site.

The real story of how this happened is yet to be fully uncovered as FTX’s founder continues to be on trial for his mismanagement of the exchange.

So what happened to FTX's customers' assets?

We’ll cover that in a later section 👇

Decentralized Exchanges (DEX)

On the opposite side of the spectrum are decentralized crypto exchanges. These exchanges do not rely on a third party to hold your funds but allow users to come together to buy and sell directly with one another.

They enable peer-to-peer trades to take place.

Sounds ideal, right?

Why go to a centralized crypto exchange when you have full control and ownership over your own money?

Well, you will need a wallet of your own. Each wallet, as we covered before, comes with a seed phrase.

The issue here is if you lose your seed phrase, you might lock yourself out from your crypto assets forever.

Importantly, there is no one that can help you recover the funds because the middleman is no longer there to help.

These platforms typically require more technical knowledge to use and involve blockchain fees when making trades.

Here are a few examples of decentralized crypto exchanges:

- UniSwap

- SushiSwap

- PancakeSwap

- Serum DEX

- Balancer

🚨 Before you get started, it’s important to know the risks when trading on a CEX or DEX.

!(https://wow-studio-foundation-cms-staging-public.s3.amazonaws.com/tableexchanges297da4fe98.png)

If you’re a beginner, it may be worth sticking to a centralized exchange until you are more comfortable and familiar with the decentralized world.

Let’s cover some quick tips to help you choose the right crypto exchange to end this chapter

Choosing the right crypto exchange

This requires some research but the good news is that most of the work has been done for you already, by existing, established platforms.

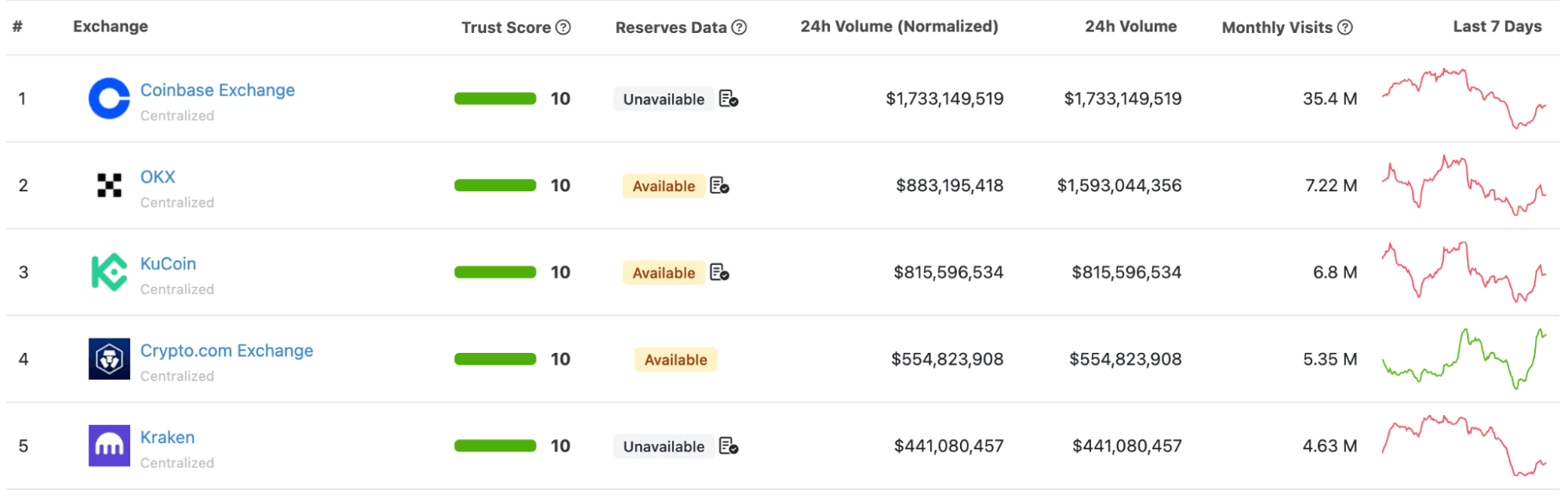

For example, CoinGecko, which is a leading cryptocurrency data aggregator, has created a list of the top cryptocurrency exchanges by Trust Score.

Trust Score takes into account a number of different metrics to rank crypto exchanges.

These factors include volume traded, the scale of operations, web traffic, trade frequency, and more.

According to CoinGecko, some of the best exchanges are Coinbase, OKX, and KuCoin.

Be sure to check the list regularly here and the exchanges’ respective Twitter accounts for the most up-to-date information.

A final note from us ❤️

If you leave your money on an exchange, you risk losing your funds if the exchange gets hacked or goes bankrupt.

This is what happened to FTX - it went bankrupt and hundreds of thousands of its users were stranded with no way to recoup their assets.

This is similar to keeping your money in a bank which then becomes a victim of a cyberattack.

In order to avoid these scenarios, there is the option of transferring to a private wallet to which only you have access – think of it like your physical wallet that you can carry around with you.

However, as mentioned in earlier chapters, your seed phase is one of the most valued assets in web3. Once this is lost, there is no way to recoup your funds.

If you don’t trust yourself to keep your assets in your own wallet, use a trusted exchange and make sure you enable two-factor authentication (2FA) as an extra layer of security.

If you are confident enough to use your own wallet, then we recommend we keep your digital assets under your own control and in your own cold wallet.