Now that we’ve covered the basics of blockchain and cryptocurrencies, you’ll be able to make some connections around how blockchain technology might just change the financial landscape.

This chapter will introduce you to Decentralized Finance (DeFi) and demonstrate where DeFi fits in the current traditional financial system.

Let’s start by recapping traditional banks as centralized financial institutions.

Although they offer different types of services, let's use one example to show how the current system works.

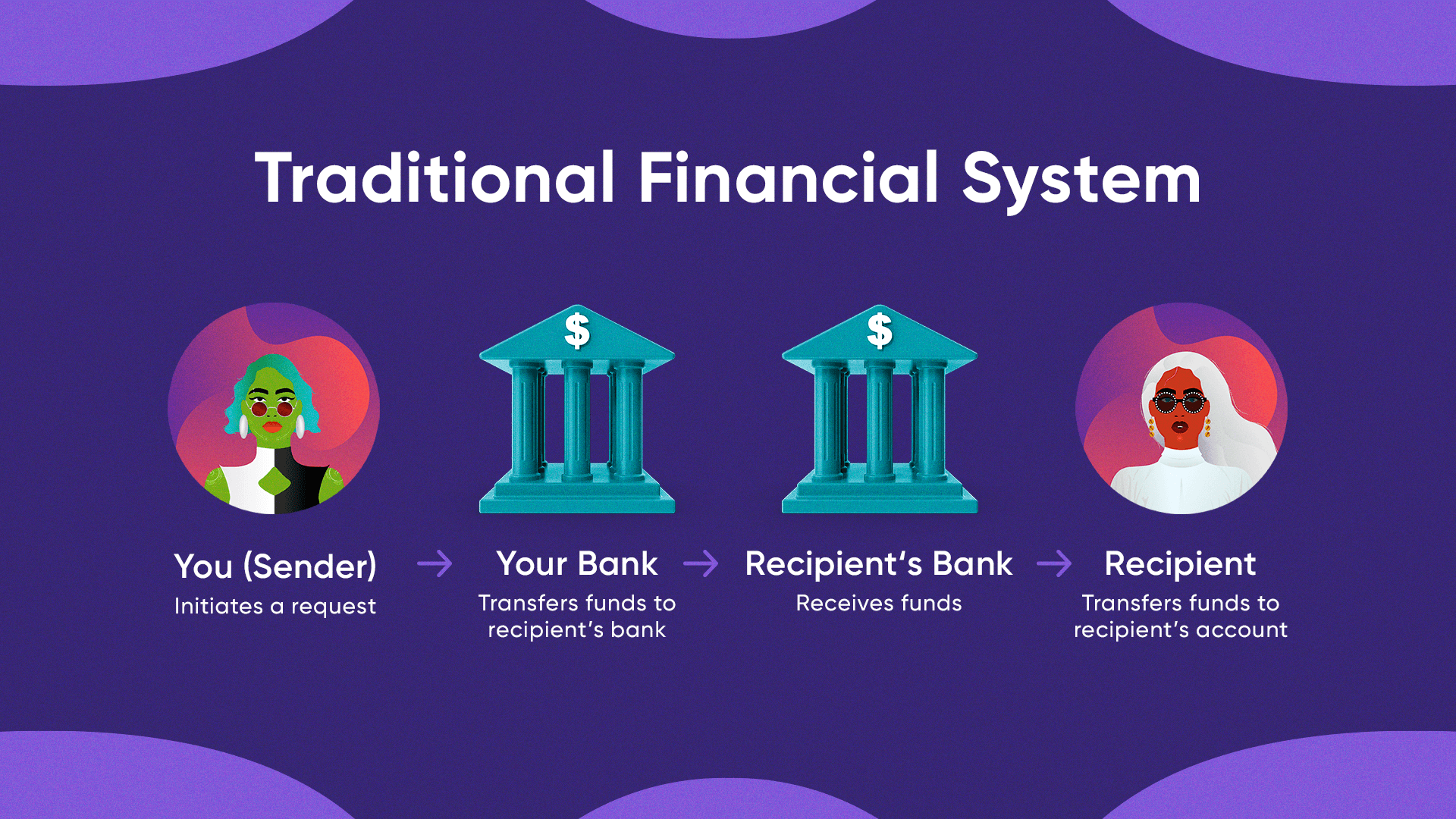

Say you want to transfer money to someone.

While smartphones and internet devices have reduced the need for physical visits to banks, there are still several steps required for a successful transaction.

One of the issues with traditional banks is time. A pain that you or someone you’re close to might know a little too well.

There can be a long process of filling out extensive documentation to verify compliance with anti-money laundering laws (AML) or some other regulation.

Even after you pass this process and initiate the transfer, there can still be a significant time delay in the time it takes for the funds to arrive in the receiver’s bank account.

Sure, the duration of the delay depends on the country, the currency used, and whether you have access to online banking and/or whether you’re attempting to make a domestic or international transfer. All in all, dealing with banks can be a slow and difficult process because of the human element involved.

At the end of the day, the main goal of a bank is to make money. They do this by earning interest on the loans they issue and charging fees for their services.

Banks assist customers in various ways, like:

- approving deposits and withdrawals

- facilitating domestic and international transfers

- offering credit lines or loans to individuals and businesses

- advising customers on where to invest their money

They’re also responsible for safeguarding their customers’ hard-earned money, offer financial advisory services, and stimulate economic activity and development.

These safeguards and limitations indicate that they are centralized entities. With that, comes limitations.